How to Download 26AS: A Complete Guide

If you are a taxpayer in India, you must be aware of the importance of Form 26AS for filing your income tax return (ITR). Form 26AS is a statement that provides details of any amount deducted as tax deducted at source (TDS) or tax collected at source (TCS) from various sources of income of a taxpayer. It also reflects details of advance tax/self-assessment tax paid, and high-value transactions entered into by the taxpayer. In this article, we will explain what is 26AS, why is it important, and how to download it from different sources.

What is 26AS and why is it important?

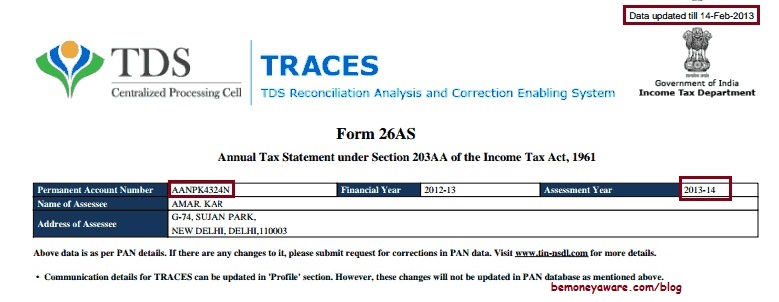

Definition and contents of 26AS

Form 26AS is an annual consolidated tax statement that shows the below information:

- Tax deducted on your income by all the tax deductors

- Tax collected at source by all the tax collectors

- Advance tax paid by the taxpayer

- Self-assessment tax payments

- Regular assessment tax deposited by the taxpayers (PAN holders)

- Details of income tax refund received by you during the financial year

- Details of the high-value transactions regarding shares, mutual funds, etc.

- Details of tax deducted on sale of immovable property

- Details of TDS defaults (after processing TDS return) made during the year

- Details of turnover as per GSTR-3B

The form provides the taxpayer with the relevant tax related information such as details of TDS and TCS, details of taxes paid in the form of advance tax and self-assessment tax, details about income tax refunds and demands and other related details. Form 26AS is an important document for filing Income Tax Return (ITR).

Benefits and uses of 26AS

Form 26AS has several benefits and uses for taxpayers, such as:

- It helps in verifying the accuracy and completeness of your income and taxes.

- It helps in claiming the correct amount of tax credit while filing your ITR.

- It helps in avoiding any mismatch or discrepancy between your ITR and Form 26AS.

- It helps in resolving any tax related queries or notices from the income tax department.

- It helps in keeping track of your financial transactions and reporting them correctly.

How to access 26AS from the new income tax website?

Steps to view and download 26AS online

You can view and download Form 26AS online from the new income tax website [incometax.gov.in](^1^) by following these steps:

- Login to [incometax.gov.in](^1^) with your user ID and password.

- Click on ‘e-file’ menu > click on ‘Income Tax Returns’ > select ‘View Form 26AS’.

- Read the disclaimer and click on ‘Confirm’ button.

- You will be redirected to the TDS-CPC website [tdscpc.gov.in](^5^).

- Agree to the terms and conditions and click on ‘Proceed’.

- Select the assessment year and view type (HTML, Text or PDF).

- Click on ‘View/Download’ to see your Form 26AS.

How to verify and reconcile 26AS with your income and taxes

After downloading Form 26AS, you should verify and reconcile it with your income and taxes to ensure that there is no mismatch or discrepancy. Here are some tips to do that:

- Compare the TDS and TCS amounts shown in Form 26AS with the TDS and TCS certificates issued by the deductors and collectors.

- Check if any advance tax or self-assessment tax paid by you is reflected in Form 26AS.

- Verify if any income tax refund received by you is shown in Form 26AS.

- Match the high-value transactions reported in Form 26AS with your bank statements and investment records.

- If you find any error or discrepancy in Form 26AS, you should contact the concerned deductor or collector or the income tax department for rectification.

How to download 26AS from other sources?

Downloading 26AS from TRACES website

You can also download Form 26AS from the TRACES website [tdscpc.gov.in] by following these steps:

- Register as a taxpayer on [tdscpc.gov.in] with your PAN and other details.

- Login to the website with your user ID and password.

- Click on ‘Form 26AS’ under ‘Statements/Forms’ tab.

- Select the assessment year and view type (HTML, Text or PDF).

- Enter the verification code and click on ‘View/Download’.

Downloading 26AS using net banking facility

If you have net banking facility with any of the authorized banks, you can download Form 26AS using your net banking account. Here are the steps to do that:

- Login to your net banking account with your user ID and password.

- Look for ‘Tax Credit Statement’ or ‘Form 26AS’ option under ‘Tax’ or ‘Services’ menu.

- Select the assessment year and view type (HTML, Text or PDF).

- Click on ‘View/Download’ to see your Form 26AS.

FAQs about 26AS

Here are some frequently asked questions about Form 26AS:

| Question | Answer |

|---|---|

| What is the difference between Form 16 and Form 26AS? | Form 16 is a certificate issued by your employer showing the details of salary income and TDS deducted from it. Form 26AS is a statement showing the details of all TDS/TCS deducted from various sources of income, as well as other tax related information. |

| How can I check if my TDS/TCS is deposited with the government? | You can check if your TDS/TCS is deposited with the government by verifying it with Form 26AS. If the TDS/TCS deducted from your income is reflected in Form 26AS, it means that it is deposited with the government. |

| What should I do if there is a mismatch between my ITR and Form 26AS? | If there is a mismatch between your ITR and Form 26AS, you should try to resolve it by contacting the concerned deductor/collector or the income tax department. You should also rectify your ITR accordingly to avoid any notice or penalty. |

| How can I download Form 26AS for previous years? | You can download Form 26AS for previous years by selecting the relevant assessment year from the drop-down menu while viewing or downloading it from any of the sources mentioned above. |

| Is there any charge for downloading Form 26AS? | No, there is no charge for downloading Form 26AS. It is a free service provided by the income tax department to all taxpayers. |

Conclusion

Form 26AS is a vital document for every taxpayer in India. It helps in verifying and reconciling your income and taxes, as well as claiming the correct tax credit while filing your ITR. You can download Form 26AS from various sources such as the new income tax website, TRACES website, or net banking facility. You should always check your Form 26AS before filing your ITR and report any error or discrepancy to the concerned authority for rectification. We hope this article has helped you understand how to download 26AS easily and effectively.

bc1a9a207d