Content

For AR and other receivables such as notes receivable, increased collection risk can cause a potential NRV concern. For other assets, such as real estate or fixed assets, market values are affected by time, obsolescence, and economic conditions, any of which can trigger NRV issues. A company performs an NRV analysis periodically, such as at year’s end or quarter’s end, or any other time when a condition arises that implicates a significant change in the fair market value of an asset. For example, a computer manufacturer’s PC inventory might decline significantly in value when a next-generation processor is released. So, the company would do an NRV analysis that compares the inventory value with the inventory’s estimated NRV.

Essentially, it estimates how much money you can actually count on getting from customers who owe you money. Understanding net realizable value of accounts receivable gives businesses clarity on their expected cash flow and helps them make better financial decisions. Net realizable value is an approach to valuing assets fairly and conservatively, and is required for compliance with GAAP and IFRS. This is because assets are initially recorded in company balance sheets based on their historical costs, but over time and for various other reasons, their fair market value might change. NRV analysis is a way to check the balances of assets on the accounting books to ensure that they are properly valued.

What Is Invoice Cost?

This is true for even recently manufactured products; companies not in tune with market conditions may be producing goods that are already outdated. NRV is used in both generally accepted accounting principles as well as international financial reporting standards . Net realizable value accounts for the value of an asset in terms of the amount it would receive upon sale, minus selling costs.

How do you calculate NRV in accounts receivable?

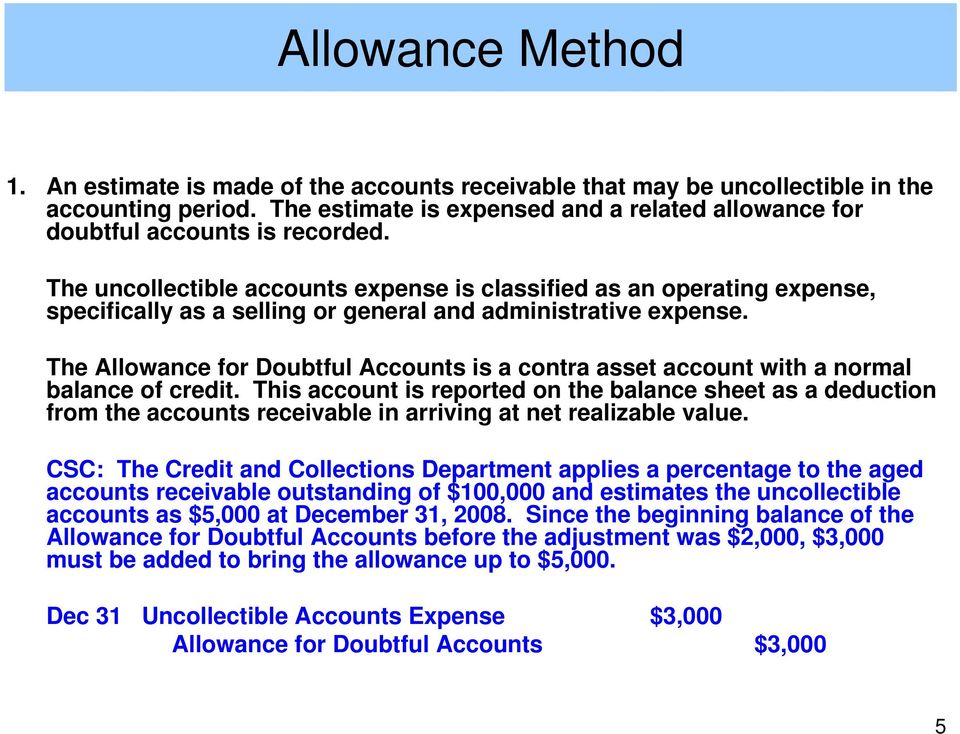

In Accounts Receivable, the NRV is computed by determining the Allowance for Bad Debts from total outstanding and then subtracting this from the Total Accounts Receivable.

Further, the open market selling price is usually so much higher than the book value that, even after deducting the costs to get ready for sale, NRV is higher than book value. This is especially true during inflationary periods and for high-margin items. However, factors like obsolescence or increasing competition can sometimes push down the open market selling price, making an NRV adjustment necessary. GAAP rules previously required accountants to use the lower of cost or market method to value inventory on the balance sheet. If the market price of inventory fell below the historical cost, the principle of conservatism required accountants to use the market price to value inventory. Market price was defined as the lower of either replacement cost or NRV.

AccountingTools

Rebekiah received her BBA from Georgia Southwestern State University and her MSM from Troy University. She has experience teaching math to middle school students as well as teaching accounting at the college level. She has net realizable value accounts receivable a combined total of twelve years of experience working in the accounting and finance fields. Requires companies to not overstate the value of an asset that can increase the profit and send some wrong signals to investors.

Add up the NRV for all items, and the result is the total net realizable value for the company’s inventory. Take a full inventory of goods available for sale to customers. NRV is also used to account for costs when two products are produced together in a joint costing system until the products reach a split-off point. Each product is then produced separately after the split-off point, and NRV is used to allocate previous joint costs to each of the products.

Sales on Credit

Here, the normal reporting of accounts receivable introduces the problem of preparing statements where the ultimate outcome is literally unknown. The very nature of such uncertainty forces the accounting process to address such challenges in some logical fashion. The reason is because the allowance for doubtful account balance will always be negative and reduces assets.

Accounts receivable is shown at its net realizable value, the amount of cash expected to be collected. Losses from bad accounts are anticipated and removed based on historical trends and other relevant information. Thus, the figure reported in the asset section of the balance sheet is lower than the total amount of receivables held by the company.

Should accounts receivable be reported at net realizable value?

Explanation: According to U.S. GAAP, accounts receivable should be reported at net realizable value, the amount expected to be collected.